Across Africa today, consumers access financial services through various channels: fintechs, traditional banks, informal community cooperatives, telco-led mobile money services, and more. This fragmentation makes the collection of payments extremely complex. And, according to Mastercard, 95% of consumer and business payments still happen in cash.

So it’s no surprise that African businesses face a major problem in collecting, reconciling, and managing the payments they receive through the various channels typically used by the average middle class African consumer: cash, bank transfers, apps, mobile money, etc. And based on data from Credrails, a First Circle Capital portfolio company, roughly 40% of transactions need manual intervention to be reconciled.

It’s an industry-wide problem. Finance departments of large & small businesses alike — especially fast-growing ones — struggle with account payables & receivables and related problems such as leakages, inefficient liquidity, gaps in working capital, revenue loss due to poor FX management & operations, and more. And at the end of the day, poor finance operations reduce the overall creditworthiness of African businesses and tamper their growth prospects.

But digital solutions have a role to play in addressing these problems. Technology and automation can help streamline various finance operations of African businesses. And one subsegment of B2B fintech infrastructure, widely known in fintech circles as “Office of the CFO,” is particularly exciting.

Sometimes, the driest-sounding businesses are the most lucrative, and this is definitely one of those gems.

Office of the CFO

Office of the CFO businesses, by definition, are fintech firms addressing various aspects of CFO or finance department operations.

They typically help automate various tasks finance departments deal with daily, monthly, quarterly, and annually, such as account payables, receivables, expense management, optimization of working capital, liquidity, cross-border revenue booking, pre-funding and much more. And they typically generate revenue via a SaaS business model, with potential additional revenue streams from payments, FX, and credit enablement.

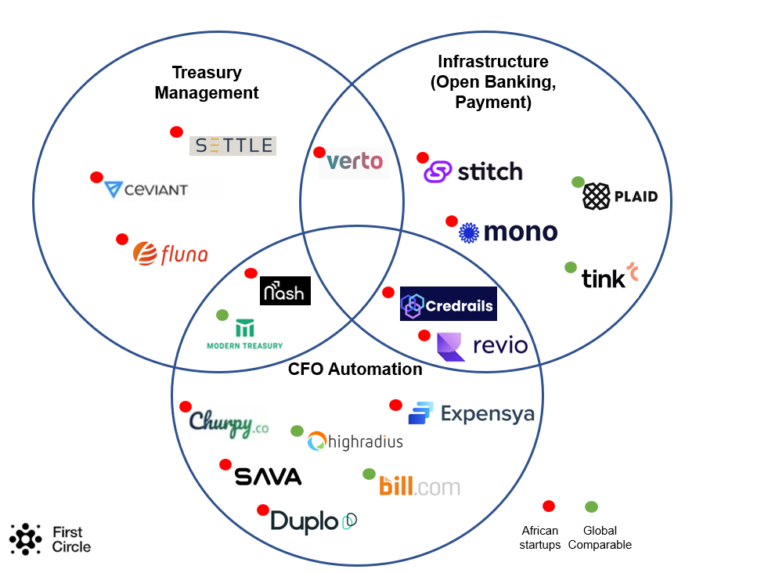

And there are three main ‘sub-sub-segments’ of the Office of the CFO sub-segment:

Select key players in Africa and corresponding models that have scaled in other parts of the world.

- ‘Pure play’ SaaS CFO Automation. Automating tasks like accounts payables, receivables, and expenses. Usually targeting small and medium enterprises. While we see solid adoption trends of these solutions by African enterprises (particularly financial services players), a key risk here is the willingness to pay/adopt a SaaS charging model by African SMEs.

- Fintech Infrastructure / APIs for Open Banking. Given the nascency of the African tech ecosystem, these models tend to struggle to scale and to provide quality service. Open banking regulations have been announced in Kenya and Nigeria but the timing is unclear.

- Treasury Management. Target customers are large enterprises with heavy balance sheets, international presence, etc. And a key challenge is building an effective enterprise sales team and shortening sales cycles. The big opportunities in Africa here generally lie in FX and working capital optimization.

While there are still challenges such as defining the right pricing models for African enterprises and SMEs, the sheer scope of opportunities — in reconciliation, FX and working capital optimization, and other areas — leave us bullish that monetization will undoubtedly come.

At First Circle Capital, we’re keen to back more companies and African leaders in the CFO Office automation space. And the recent ‘nine-figure acquisition’ of Tunisian expense management company Expensya — a company I backed in 2018 — by Sweden’s Medius, is yet another proof point that African companies can compete and win against global peers in this area.

The Expensya acquisition is part of a plan by two of Europe’s most prominent private equity tech investors to create a global CFO automation giant. To learn more about Expensya’s story, listen to the podcast below featuring Expensya Co-Founder & CEO Karim Jouini.

Share: